If you’re in the market for an electric bike, you’ll want to know what the max speed is for each class. This article will tell you all about the different classes and their max speeds.

What is an e-bike?

An e-bike is a type of bike that uses an electric motor to help you pedal. They are usually much smaller and lighter than traditional bikes, which makes them easier to ride.

2. How fast can an e-bike go?

The maximum speed of an e-bike depends on the model you buy. Some e-bikes can travel up to 20 mph, while others only go up to 12 mph. Because they’re so small and lightweight, most e-bikes don’t have pedals or a saddle. You simply lean on the handlebars to pedal.

What are the different classes of e-bikes?

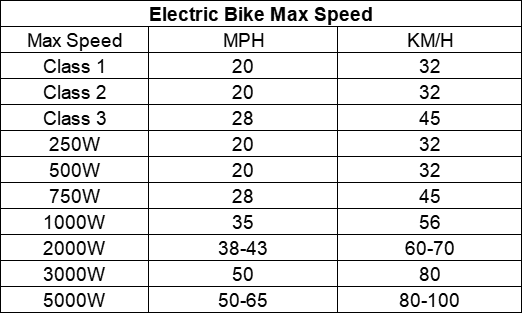

There are a few different classes of e-bikes, each with its own max speed.

The class of e-bike that is the most common is the Class 1 e-bike. This bike has a max speed of 20 mph, which is enough to ride on most roads without getting too worried about the safety of others.

If you want to go faster, you can get a Class 2 e-bike. This bike has a max speed of 25 mph, which isperfect for most people who want to use their bike for transportation but still want to stay safe on the road.

If you want to go even faster, you can get a Class 3 e-bike. This bike has a max speed of 30 mph, which is perfect for people who need to travel quickly and safely.

No matter what class of e-bike you get, always make sure to obey all traffic laws and stay safe while riding your bike.

How powerful are e-bikes?

Powering an e-bike is basically like pedaling with a mini engine. The more power you put into the pedals, the faster you can go.

An e-bike’s power is measured in watts. The higher the wattage, the more powerful the bike. Most e-bikes have a wattage of 20 to 250.

E-bikes are legal to ride on most trails and roads. The only restriction is that they cannot be ridden on pavement or on bike paths that are specifically designed for bikes.

The max speed of an e-bike depends on its wattage and how well it is built. A 25-watt e-bike can travel up to 20 mph, while a 250-watt e-bike can travel up to 28 mph.

Which e-bike is right for you?

Whether you’re looking for an e-bike to commute to work, ride recreationally, or explore new trails, there’s a bike that’s perfect for you.

When shopping for an e-bike, make sure to consider your purpose for using it. There are three types of e-bikes: commuting, recreational, and special purpose. Commuting e-bikes are designed for use on city streets and sidewalks. They have low speeds and limited range, so they’re best suited for short trips. Recreational e-bikes are designed for use on trails and other open areas. They have high speeds and long ranges, so they’re perfect for exploring new areas. Special purpose e-bikes are designed for use in specific situations, like cargo hauling or providing assistance in mobility challenges. They have unique features that make them perfect for those applications.

Once you decide which type of e-bike is right for you, consider your height and weight. E-bikes come in different sizes to fit everyone. Plus, different motors provide different levels of power, so you can choose the level of power that’s right for you.

Finally, be sure to read the reviews before you buy an e-bike

How to choose the right e-bike for you

There are a lot of factors to consider when choosing the right e-bike for you. Here are a few tips to help you choose the right one.

1.Choose the right size. Most e-bikes come in different sizes, from small enough for small children to large enough for adults. Make sure to choose the right size for you and your riding needs.

2. Choose the right type of e-bike. There are three main types of e-bikes: pedal assist, throttle only, and motor assisted. pedal assist e-bikes use a motor to help you pedal, while throttle only e-bikes have a throttle that you use to control the speed of the bike. motor assisted e-bikes have a motor that helps you pedal and also helps power the bike, making it easier to ride.

3. Choose the right level of difficulty. Some e-bikes are designed for beginners, while others are more challenging for experienced riders. Choose the level of difficulty that is right for you.

4. Consider your budget. The cost of an e-bike varies depending on its features and size, but most start around $300.

Conclusion

E-bikes come in all shapes and sizes, with different max speeds. This guide will give you an idea of the max speed for each class of e-bike, based on the power output of the bike. If you’re looking to buy an electric bike, knowing what class it falls into is important so that you know how fast it’s capable of going. Be sure to also check out our buyer’s guide to find out more about specific features to look for when buying an e-bike.